Frequently Asked Questions

Typically, from application to live gaming, the process can take 3-4 months. In some instances, a location can be licensed within a 2-month period.

Learn more about Illinois Video Gaming License requirements and How to Start an Illinois Slot Machine Business.

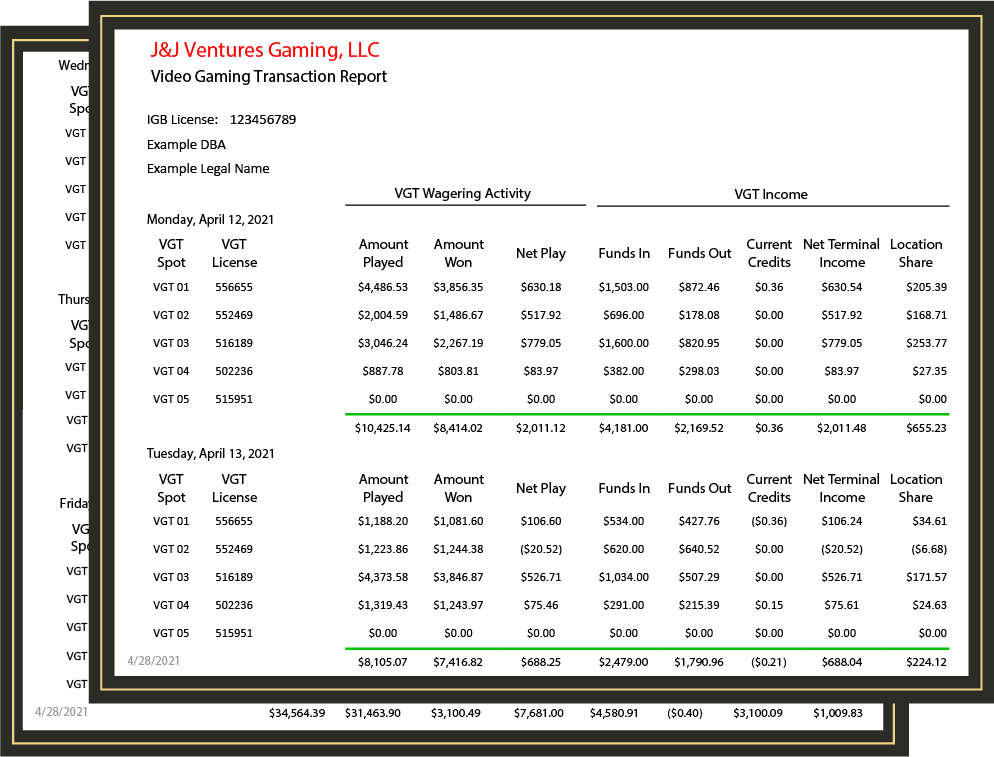

FlexPay offers our establishments the ability to choose how often they are paid for their share of the gaming revenue. FlexPay options include: twice per week, weekly, twice per month, and monthly options. To move to another FlexPay option, email reports@flexpay.jjventures.com or contact J&J Gaming. Payment will be directly deposited into the company account you choose.

– One-time Application fee to the Illinois Gaming Board is $100

– Annual state gaming license is $100

– Municipality fees vary from municipality to municipality

– J&J Ventures Gaming will help you through all licensing fee processes

Currently, live gaming revenue for all locations is public record on igb.illinois.gov. We can help you research what your area and type of business tends to generate.

Applicants can qualify one of 4 ways:

- Retail (liquor pouring establishments only)

- Fraternal or Veterans Establishments

- Truck Stop Establishments:

– Three acres of property, 10K gallons of diesel sold monthly, truck parking, and convenience store - Large Truck Stop Establishments:

– In addition to the other requirements for traditional Licensed Truck Stop Establishments, an establishment must be located within three road miles of a freeway interchange and sell on average 50K gallons (instead of 10K gal) of diesel fuel per month.

Learn more about Illinois Video Gaming License requirements and How to Start an Illinois Slot Machine Business.

All licensed establishments can have up to six (6) VGTs if allowed by the municipality. Licensed Large Truck Stop Establishments can have up to ten (10) VGTs.

The state of Illinois mandates the distribution of the Net Terminal Income. The distribution, based on percentage, is as follows:

| Administrative Share | Local Tax | State Tax | Establishment Share | Terminal Operator Share | |

|---|---|---|---|---|---|

| Before 7/1/19 | 0.8513% | 5% | 25% | 34.57435% | 34.57435% |

| 7/1/19 – 6/30/20 | 0.8513% | 5% | 28% | 33.07435% | 33.07435% |

| 7/1/20 | 0.8513% | 5% | 29% | 32.57435% | 32.57435% |

| 1/1/2024 | 0.92% | 5% | 29% | 32.54% | 32.54% |

Find information on income split and the history of video gaming.

You will need to obtain both a local and state liquor license.

Local: Contact the city your establishment is located in to determine their specific laws and steps you’ll need to follow.

State: State of Illinois Liquor Licenses are issued by the Illinois Liquor Control Commission (ILCC), and you will be required to fill out an application. Learn more on how to obtain an Illinois liquor license and how to renew an Illinois liquor license.

If you are looking to switch terminal operators, J&J Gaming is here to assist you through the entire process from license and compliance assistance to getting you set up with the best mix of games and a custom marketing plan. J&J Gaming is the most-trusted terminal operator and has the team to support you with minimal downtime and a quick transition so you can maximize your revenue. J&J Gaming is the true full-service partner.

Typically, from application to live gaming, the process can take 3-4 months. In some instances a location can be licensed within a 2-month period. We will provide similar opportunities to new states as gaming becomes available.

J&J Gaming is the only terminal operator to allow establishments the option to choose how often they are paid through our unique FlexPay system. We will provide the same FlexPay opportunities to new states as gaming becomes available.

Although casinos also carry Video Gaming Terminals, the player experience in establishments such as bars, restaurants, and truck stops differs from that of a casino.

Communities depend on clubs and bars. Just ask the little leagues or community parades. Clubs and taverns have been financially supporting communities for decades. This will help them remain a vibrant partner within the community.

The lottery and VGTs are not correlated. VGTs are a unique form of entertainment that provides a social interaction among patrons.

Because the revenue share generated from video gaming includes local municipalities, many county and local governments are in favor of video gaming, as the earned revenue can be put towards infrastructure, education, and more.

There is currently a proposed bill to legalize video gambling, but that bill to allow video lottery terminals has yet to be passed. J&J Gaming welcomes and encourages Missouri business owners to contact our team so we can answer your questions, discuss video gaming details, and help you and your business prepare for the impending legalization of video gaming.

Typically, from application to live gaming, the process can take 3-4 months. In some instances a location can be licensed within a 2-month period. We will provide similar opportunities to new states as gaming becomes available.

J&J Gaming is the only terminal operator to allow establishments the option to choose how often they are paid through our unique FlexPay system. We will provide the same FlexPay opportunities to new states as gaming becomes available.

Although casinos also carry Video Lottery Terminals, the player experience in establishments such as bars, restaurants, and truck stops differs from that of a casino.

Communities depend on clubs and bars – just ask the little leagues or community parades. Clubs and taverns have been financially supporting communities for decades, and this will help them remain a vibrant partner. Additionally, county and local governments are asking for this, as the generated revenue from VGTs includes a local share for every county and municipality.

The state’s lottery will not be affected. VLTs will be run through the lottery.

Once the bill is passed, select establishments with liquor licenses and gaming licenses from the Missouri Gaming Commision will be able to enter into a written agreement with a terminal operator, such as J&J Gaming. Because the law has not yet been passed, the number of terminals permitted and other specifications are still being determined. According to the proposed bill, no license shall be issued to any person who has been convicted of a felony or crime involving illegal gambling. Keep up with J&J Gaming for information on Missouri Gaming, the passing of the proposed bill, regulations and specifications, and whether or not your business is eligible to install video gaming machines.

While we can’t say exactly how much of an increase in revenue a Missouri establishment will experience by installing video gaming machines, we can reasonably compare it to the Illinois video gaming market. Location owners in Illinois are earning an additional $121,000 per year through video gaming. See how J&J FlexPay gives establishments the ability to choose how often they are paid for their share of the gaming revenue.

Establishments that will be able to install video gaming in Missouri will likely be truck stops, fraternal and veterans organizations, bars, restaurants, and more. Check in regularly with J&J Gaming for updates on regulations and qualifications regarding establishments’ eligibility for installing video gaming machines.

*Avg. location share for live J&J accounts, 7/21-6/22.

While specific games and manufacturers have not been explicitly declared, we anticipate that the video gaming machines allowed in Missouri will be comparable to those in Illinois. J&J Gaming provides our partnering locations with the most popular games in the industry from manufacturers like Spielo International, Bally Technologies, Scientific Games, WMS, IGT, Novomatic, Aristocrat, and more! Should the current bill pass, it’s expected that no more than six video gaming terminals per establishment will be allowed.

It typically takes 2-3 months after submitting an application to the State of Montana until live gaming.

– Annual permit of $240 for each VGM permit.

– Montana state tax of 15% is taken from the gross revenue generated from each VGM.

– Golden Route Operations will help you through all licensing fee processes.

Establishments are permitted to have up to 20 video gambling machines in one location.

The State of Montana tax of 15% comes off the top during a weekly or biweekly collection. Business license fees may apply in some municipalities and costs may vary.

Individuals can qualify for video gaming by acquiring a license through the Gambling Control Division with the Montana Department of Justice.

The applications for a video gaming license can be found at: www.dojmt.gov/gaming.

If you are looking to switch route operators, Golden is here to assist you through the entire process from license and compliance assistance to getting you set up with the best mix of games and a custom marketing plan. Golden Route Operations is the most-trusted route operator and has the team to support you with minimal downtime and a quick transition so you can maximize your VGM revenue. Golden is the true full-service partner.

Each establishment varies, but typically from application to live gaming, the process can take 2-3 weeks.

FlexPay offers our establishments the ability to choose how often they are paid for their share of the gaming revenue. FlexPay options include: twice per week, weekly, twice per month, and monthly options. To move to another FlexPay option, email reports@flexpay.jjventures.com or contact J&J Gaming. Payment will be directly deposited into the company account you choose.

Applicants can qualify for regulated skill gaming by acquiring an annual license to operate machines and devices in the State of Nebraska through the tax commissioner.

The application for regulated skill gaming is Form 57 which can be found at: https://revenue.nebraska.gov/gaming/mechanical-amusement-devices-cash-devices-other-gaming

All Licensed establishments can have up to (4) regulated skill gaming machines in one location, unless the establishment meets the square footage qualifications that are listed below, which could allow up to (15).

| Square Feet | Number of Permissible Devices |

|---|---|

| 0 to 4,999 | Up to 4 |

| 5,000 to 5,999 | Up to 5 |

| 6,000 to 6,999 | Up to 6 |

| 7,000 t9o 7,999 | Up to 7 |

| 8,000 to 8,999 | Up to 8 |

| 9,000 to 9,999 | Up to 9 |

| 10,000 to 10,999 | Up to 10 |

| 11,000 to 11,999 | Up to 11 |

| 12,000 to 12,999 | Up to 12 |

| 13,000 to 13,999 | Up to 13 |

| 14,000 to 14,999 | Up to 14 |

| 15,000 or more | Up to 15 |

Square footage does not include outdoor seating areas, parking areas, or any other similar areas determined by the department of revenue.

In Nevada, establishments like bars, restaurants, casino resorts, golf courses, laundromats, convenience stores, grocery stores, and truck stops, are able to install video gaming machines.

* Accessibility to video gaming machines is reliant on your location’s regulatory zone. Please reach out to Golden for further details.

Golden provides advantageous and competitive distributed gaming contacts for all our partners.

– Participation is a partnership between your establishment and Golden with an agreed upon split.

– Space Lease is for locations not licensed with the Nevada Gaming Control Board and Golden houses equipment in your establishment with an agreed upon “rent” amount.

If in need of technical assistance for your Golden equipment, please call the 24/7 service number and Golden’s closest tech will be dispatched to assist.

Our exclusive platform, Golden Edge (GE) Player Tracking, is designed to create a seamless integration between the owner and the operator by offering insight in your business growth, player tracking, and performance reports! Contact us to learn more on how this platform can benefit you!

If you are looking to switch route operators, Golden is here to assist you through the process, contact a Golden Route Operation rep today at (702) 790-0280.

Currently, there is a proposed bill to legalize video gaming, but that bill has yet to be passed. Once gaming is legalized, we look forward to partnering with establishments located in North Carolina. J&J Gaming encourages North Carolina business owners to contact us to ask questions, learn about details of video gaming, and how to better prepare your business for once video gaming becomes permitted.

Typically, the process from application to live gaming can last anywhere from 3-4 months, while in some cases, licensing can be completed within a 2-month period.

As the only terminal operator to provide a unique FlexPay system, J&J establishments have the option to choose how often they prefer to be paid. As new states become available, J&J Gaming is prepared to provide the same FlexPay opportunities.

Although casinos also carry Video Lottery Terminals (VLTs), the player experience in establishments such as bars, restaurants, and truck stops differs from that of a casino.

The state’s lottery will not be affected. Video lottery terminals will be run through the lottery.

Once the bill is passed, the establishments with approved liquor and gaming licenses from the North Carolina Lottery Commission may enter into a written agreement with a terminal operator, such as J&J Gaming. With the proposed bill not yet passed, the specific regulations are still being determined. According to the bill, no license shall be issued to any person who has been convicted of a felony or crime involving illegal gaming, anyone under the age of 21, or not current in filing taxes. Stay up to date with J&J Gaming for more information on the legalization of the proposed bill, regulations, and whether your business is eligible to install video lottery terminals.

Video gaming is forecasted to generate $925.1 Million in tax revenue and provide an economic impact of $3.1 Billion GDP. To learn more on how distributed gaming can bring great success to your state visit our Advocacy page.

-

- * The study and it’s data have been created by FTI Consulting for use of J&J Gaming.

- * (May 2023) Economic and Fiscal Impact of Video Gaming Terminals in Illinois and Nationally, FTI Consulting.

- * Study can be found at www.jjventures.com/advocacy

In North Carolina, establishments like truck stops, fraternal and veteran organizations, bars, restaurants, and more, will be able to install video gaming. Contact J&J Gaming to stay up to date on the status of establishment eligibility and regulations.

Should a bill pass, J&J is prepared to provide our partnering location with state-of-the-art video slot machines from leading manufacturers like Spielo International, Bally Technologies, Scientific Games, WMS, IGT, Novomatic, Aristocrat, and more! We can assume that the gaming machines permitted in North Carolina will be similar to those in Illinois. According to the current proposed bill, we can expect that each establishment will be able to house no more than 5 video lottery terminals.

Typically, from application to live gaming, the process can take 5-6 months.

FlexPay offers our establishments the ability to choose how often they are paid for their share of the gaming revenue. FlexPay options include: twice per week (semi-weekly), weekly, twice per month (semi-monthly), and monthly options. To move to another FlexPay option, email reports@flexpay.jjventures.com or contact your account rep. Payment will be directly deposited into the company account you choose.

-42% state tax (which ultimately goes to the general fund)

-10% local tax

-15% to the Truck Stop Establishment

-The remainder to the Terminal Operator (less the bi-monthly regulatory assessment imposed by the PGCB)

-Be equipped with diesel islands

-Sell an average of 50,000 gallons of diesel or biodiesel each month for previous 12 months, or projected for the next 12 months

-Have at least 20 parking spaces dedicated to commercial motor vehicles

-Have a convenience store (Currently no specific requirements/description of “convenience store”)

-Be situated on a 3-acre parcel that the Truck Stop Establishment owns or leases

-Not be situated on any property owned by the Pennsylvania Turnpike

-Be licensed as a Lottery Sales Agent under the Pennsylvania State Lottery Act.

Although casinos also carry Video Gaming Terminals, the player experience in establishments such as bars, restaurants, and truck stops differs from that of a casino.

Communities depend on clubs and bars. Just ask the little leagues or community parades. Clubs and taverns have been financially supporting communities for decades. This will help them remain a vibrant partner with the community.

The lottery and VGTs are not correlated. VGTs are a unique form of entertainment that provides a social interaction among patrons.

Because the revenue share generated from video gaming includes local municipalities, many county and local governments are in favor of video gaming, as the earned revenue can be put towards infrastructure, education, and more.

When you are looking for a specific location by name on the Home screen, just enter the first few letters of the name of the location in the Search Bar above the locations list. All results matching the letters or name will be dynamically filtered in the location list below. The more letters of the specific location name you enter in the Search Bar the more precise the search results will become.

The home screen shows you the closest 25 locations in order from closest to farthest. So the first location listed is the closest location to you. You can see an additional 25 locations by tapping the See More Locations button at the bottom of the locations list. Please note that your device’s Location Services (GPS) must be active for this location feature to work properly. (See question 8)

Favorites enable you to easily save your favorite locations and make their contact information and details easily accessible in the Favorites screen. When you are on the Locations Detail screen where the location’s Name, Directions, and Hours are shown, just tap on the star icon that is next to the location’s name. The star will refresh and go from white to red. That location will now be listed in the Favorites.

The Promos screen shows all ongoing Promotions that are close to your current location when you tap on the Promos button. Please note that your device’s Location Services (GPS) must be active for this location feature to work properly. (See Question 8)

The inbox receives promotions happening at the location(s) you have favorited or local locations. When these locations have special Promotions you will receive a message in your Inbox. Tapping and opening a message in your Inbox will give you more specific information about the Promotion.

Messages in your Inbox will remain for a set amount of time, which is controlled by each location and specific to each individual message. Generally, a message will remain until the specific Promotion contained in the message has expired or the message content is no longer actionable.

Please make sure that you have completed the registration process and verified your email address. Once you are sure your registration is complete, please make sure your location services and push notifications are on. These can be found in the Settings area of your phone or tablet. Please note: Previously sent messages will not be resent once you have turned on your location and push services. You will receive all future messages sent by J&J Ventures Gaming.

iPhone: Leave the J&J Locations app. On your iPhone, touch Settings. Touch Privacy. Touch Location Services. Scroll down and touch J&J Gaming. Choose to allow location access While Using the App or Always.

Android: Leave the J&J Locations app. On your mobile device, touch settings. Touch Location. Depending on your device and version of the Android OS, make sure all options such as Location, Location services, and Location reporting are enabled. Select an accuracy setting. Note: The names of these options, menus, and menu items can vary by Android device.

J&J Ventures is the leading route operations and distributed gaming terminal operator in the United States. Established in 1929, we are the trusted industry leader across Gaming and Amusements. J&J Ventures is the parent company for J&J Gaming, J&J Amusements, and Golden Route Operations, all of which play a role in successfully supporting and fostering growth for our partnered establishments. With headquarters located in Effingham, Illinois, J&J Ventures has grown to operate across eight states in the US with plans to continue expanding our footprint.

For decades, J&J has cultivated and developed a strong brand that is widely recognized by establishments and customers as one of great service, integrity, reliability, and industry knowledge. We have a leading professional management team with expertise in route management, accounting, marketing, data & analytics, and account management to bring our partnered locations the tools of success and growth.

J&J Gaming is the largest privately held licensed terminal operator with partnered locations in Illinois, Pennsylvania, and Nebraska. J&J Gaming advocates for responsible distributed gaming and its benefits to support communities and small businesses across the country.

J&J Amusements has been providing our partnered establishments with dart machines, pool tables, jukeboxes, arcade games, and ATMs to improve patron experiences for decades. J&J is the largest Illinois-based operator of amusement devices with an expanding footprint across Indiana, Kentucky, Missouri, and Wisconsin.

Golden Route Operations offers premier distributed gaming experiences across the Montana market as a licensed Video Gambling Route Operator. Golden Route Operations provides Montana establishments and their patrons access to exciting and elite video gaming experiences in bars and taverns, and large establishments, also known as “casinos.” Golden Route Operations also provides leading expertise and top-of-the-line equipment in Amusements to partnered locations in Montana.